Covid-19 and Even More Unconventional Economic Policies

https://doi.org/10.71609/iheid-fn65-ya03Following the collapse of Lehman Brothers in September 2008 and the onset of the Global Financial Crisis (GFC), central banks around the globe, led by the Federal Reserve Bank of the United States (Fed), introduced monetary policy measures that were quickly termed ‘unconventional’. For the general public, the most salient of these measures was the introduction of zero and negative interest rates. Less known, but even more unconventional, was the purchase of corporate bonds and a variety of private debt obligations by central banks. Central banks also initiated ‘macro-prudential’ measures such as demanding banks to hold countercyclical buffers and constraining the ability of households to leverage housing loans that were aimed at strengthening the resilience of the financial system.

These measures were unconventional both from a monetary policy and a political perspective. Central Bank Independence (CBI) evolved, and in many countries was legally mandated, to allow an unelected public institution to manage an inflation target assigned by an elected government. Unconventional and macro-prudential policies took CBI further into the realm of quasi-fiscal activities with much more significant distributional effects than conventional policies. This set in motion a gradual blurring of the borders between fiscal and monetary policies on the one hand and between the accountability of elected and unelected policymakers on the other. Moreover, despite popular sentiments about the prevalence of a neoliberal world-order based on laissez-faire, these policies moved us in the opposite direction of increased intervention.

CENTRAL BANKS REACTED TO THE COLLAPSE IN FINANCIAL MARKETS AS COVID-19 BEGAN TO SPREAD

The world economy had hardly started to normalise after the GFC when Covid-19 hit. As in the GFC, financial markets were quick to collapse (Figure 1). Armed with their experience from the GFC, central banks reacted immediately by providing liquidity to the financial system, injecting international US dollars and purchasing assets. The Fed increased its balance sheet by three trillion dollars immediately. By comparison, it took five years, from 2008 to 2013, for the Fed to carry out a similar increase. The European Central Bank followed suit with a one trillion Euro increase to its balance sheet. These emergency steps stabilised financial markets (Figure 1) and likely prevented the coupling of a health crisis with a financial crisis.

GOVERNMENTS, TOO, DEPLOYED UNCONVENTIONAL ECONOMIC POLICY TOOLS

Whereas central banks made use of the unconventional tools they acquired and mastered during the GFC, it was now the turn of governments to revert to unconventional economic policy tools. Historical economic downturns since World War II have been a consequence of economic disruptions: cyclical swings in economic activity, speculative booms, oil prices, excessive government deficits, etc. For the first time, on a national level, governments shut down substantial parts of the economy and economic life to contain a pandemic For the first time, on a national level, governments shut down substantial parts of the economy and economic life to contain a pandemic. In most cases, they did so by decree. Therefore, unlike situations where some may question the necessity of governments intervening in economic downturns, this time was different.

Governments in countries that had partial lockdowns in place effectively confined anywhere between 15 to 30 percent of the workforce at home and, in extreme cases such as the almost full lockdown in New Zealand, almost 60 percent. For some economies, these numbers exceed those of the Great Depression of the 1930s when the unemployment rate reached 20 percent in many European countries. Governments thus initiated programs of economic assistance to cushion the economic consequences of the lockdowns they had imposed. They introduced innovative support instruments such as paid leave, cash transfers to families, cash transfers to businesses, loan guarantees and more. Governments also deferred tax payments. These extraordinary measures are expected to raise the government deficit in the United States to 15 percent of GDP. In the Euro area, governments were freed from the Stability and Growth Pact constraints that remained binding even during the GFC.

Similar to central banks’ unconventional policies that reversed trends of financial liberalization, unconventional government policies are a stark departure from prevalent neoliberal paradigms These exceptional measures have increased the role of the state in the economy – from labour and business support to the de-facto nationalisation of airlines. Similar to central banks’ unconventional policies that reversed trends of financial liberalisation, unconventional government policies are a stark departure from prevalent neoliberal paradigms. While the monetary policy response, unconstrained by political haggling, is known for its responsiveness, the magnitude and speed of governments’ intervention in reaction to the pandemic seems unprecedented and almost unimaginable before March 2020.

THE ECONOMIC OUTLOOK DEPENDS TO A LARGE EXTENT ON WHETHER THERE IS A SECOND OR THIRD WAVE OF INFECTIONS

The economic forecast for the remainder of 2020 and for 2021 depends, first of all, on whether Covid-19 will produce a second or third wave of infections. However, even if we have seen the worst of the pandemic, its medium-term economic repercussions vary by country, length and severity of exposure to Covid-19.

We can use the following analogy to describe the pandemic’s economic impact. Suppose we are driving a car at a speed of 60 km/h from home to work. It is a 10 km drive that usually takes us 10 minutes. One morning, there was some road work and a traffic light was introduced. We stopped at the red light for five minutes. The light turned green and, our car being in good working condition, we resumed our trip and arrived late to work. We lost five minutes and our effective speed was reduced from 60 km/h to 40 km/h. Looking back, this was a bad day and there is no way to return the time lost. Perhaps our five-minute delay caused a chain reaction at work that will entail additional losses. Going forward, we will take into account the change to our commute and adjust our schedules. Now compare this scenario with one where we were involved in a road accident on the way to work that damaged our car. Now we need a tow truck, to activate our insurance, etc. A standard business cycle downturn looks like a road accident and Covid-19 lockdowns might look more like a temporary red light. Reality probably lies somewhere in between.

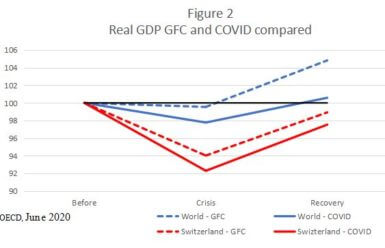

The most recent forecast issued by the OECD in June suggests that the economic damage created by the reaction to Covid-19 is greater than that of the GFC of 2008. It also suggests that recovery will take longer (Figure 2). However, economic forecasts are based on the ‘road accident’ scenario that could prove too pessimistic. First, unlike the excess of 2008, many economies entered this crisis in good shape and without financial imbalances. Second, this time, the policy response was more forceful and more timely: central bank reactions were faster and more comprehensive and governments rapidly engaged in unconventional fiscal policies. Financial markets seem to be more optimistic (Figure 1) than the OCED forecast would imply (Figure 2).

What if a second infection wave were to hit this fall? Now is the time to examine the tool kit to see what was effective and what less so, and, perhaps, to add a few new instruments. One cue comes from the United States: the Fed innovated by lending to ‘main street’ businesses. Most governments have likewise been willing to provide loan guarantees to businesses and, in tandem, have allowed banks to increase the riskiness of their loans. This may seem like a roundabout way of doing things that jeopardises the banking system and still depends on the banks’ willingness to lend. Yet this innovation by the Fed, in continuation of previous unconventional policy, further blurs the boundaries between monetary and fiscal policy and compromises the role of central banks as independent institutions.

EVEN MORE UNCONVENTIONAL MEASURES MAY BE POSSIBLE

Another, perhaps even bolder move, would be to speed up the issuance of national digital currencies with the aim of improving real-time retail payment systems. Owing to the lockdowns, shopping moved to a considerable extent online and the use of cash declined significantly — also for sanitary considerations. Any hope by cryptocurrency advocates that the crisis would solidify their position as currencies because of quasi-fiscal monetary policy action by central banks were dashed by their collapse just like other financial assets (Figure 1). Central banks could seize the moment and usher in a new era of national e-currencies, reaping the many opportunities this would create for monetary policy in general and unconventional monetary policy in particular. Imagine that instead of relief checks in the mail, central banks will credit citizens via an online platform. Central bankers could become even more creative with their balance sheets, for example buying portfolios of small business or consumer loans made by banks in relation to the effects of the lockdowns.

The unprecedented economic measures taken during the Covid-19 crisis have redefined the scope of both monetary and fiscal policy and have the potential to push the frontier even further. The measures were taken, in many instances, under the cloak of ‘emergency circumstances’. When the crisis abates, we should examine the economic efficacy and the institutional aspects of these policies.In times of severe crisis, people turn to governments and not to markets for solutions To what extent did they infringe on civil liberties, on the balance of power between political institutions? Do they require constitutional changes, etc.? Covid-19 has provided us with a bitter-tasting sample of what the impact of future disasters could look like. In times of severe crisis, people turn to governments and not to markets for solutions. We should incorporate lessons drawn from this crisis on the role of unconventional monetary and fiscal policies to prevent and mitigate the impact of future crises such as those likely induced by global warming.

Electronic reference

Sussman, Nathan. “Covid-19 and Even More Unconventional Economic Policies.” Global Challenges, Special Issue no. 1, June 2020. URL: https://globalchallenges.ch/issue/special_1/covid19-and-even-more-unconventional-economic-policies. DOI: https://doi.org/10.71609/iheid-fn65-ya03.The issue has been produced by the Albert Hirschman Centre on Democracy in collaboration with the Graduate Institute’s Research Office. It includes contributions from all of the Institute’s research centres and departments.

Confederation billions to save the Swiss economy | PODCAST with Cédric Tille

Research Office, The Graduate Institute, Geneva

Peut-on comparer la grippe espagnole et le Covid-19? VIDÉO avec Davide Rodogno

Graduate Institute, Geneva et Heidi.news

What hope for the environment? PODCAST with Joëlle Noailly

Research Office, The Graduate Institute, Geneva

PODCAST | The violent consequences of the Covid crisis in India, with Rahul Mehrotra

Research Office, The Graduate Institute, Geneva

New technological tools: a plus for democracy? PODCAST with Jérome Duberry

Research Office, The Graduate Institute, Geneva

Latin America and the Covid-19 crisis | PODCAST with Yanina Welp

Research Office, The Graduate Institute, Geneva

An Indonesian democracy at risk | PODCAST with Jean-Luc Maurer

Research Office, Graduate Institute, Geneva

Democracy in coronavirus times | VIDEO with Shalini Randeria and Ivan Krastev

The Graduate Institute, Geneva (Excerpt of the podcast series “In Conversation With“)