Systemic Risk in the Financial System

The 2008 crisis reflected an internal build-up of excesses in the financial system – a so-called “endogenous risk” – rather than an external exogenous disruption such as COVID. Years of low volatility had made lenders complacent to a large build-up of leverage, with regulators not seeing the danger soon enough. Not only was the imbalance large, it was present in segments of markets subjected to limited oversight.

Policymakers reacted rapidly once the crisis burst. They took the issue of leverage more seriously and implemented a range of more stringent limits, such as requiring large “too big to fail” institutions to hold bigger cushions of capital. Reform efforts have surely not been perfect, and in many instances could have gone further, but several steps were adopted that would have been unthinkable beforehand, such as the entrustment of the European Central Bank (ECB) with the supervision of large European banks. Central banks also have started paying much more attention to financial stability. As a result, the financial system entered 2020 in a better shape than it entered the 2008 crisis.

Will COVID lead to a financial crisis?

It may, but it would be a different crisis than in 2008. While in March financial markets showed bottlenecks that were reminiscent of 2008, the situation was rapidly addressed by an aggressive reaction of central banks.the most severe recession since World War II could trigger a wave of bankruptcies and losses for banks The main concern is not so much that excesses have built up within markets, but that the most severe recession since World War II could trigger a wave of bankruptcies and losses for banks. As the amounts of debt owed by households and firms has kept increasing since the last crisis, an insolvency crisis is a serious risk.

The buffers built by regulators, such as limits on the size of mortgages, constitute a first line of defence. Macroeconomic support policies constitute a second one. These include the broadening of unemployment benefits, including for workers with reduced worktime, and financial support to firms facing a temporary drop in business. These income support policies reduce the risk of borrowers defaulting on their obligations. Should bankruptcies unfortunately not prove avoidable, a third line of defence is for policymakers to spread them through time to prevent a concentrated wave of insolvencies from magnifying financial distress by pushing collateral prices further down. An injection of public funds to recapitalise banks would also be an option. While this is never a popular policy, the current problem is not due to excesses by lenders, and direct support has often proved less costly than a very long period of stagnation due to ailing banks.

Looking beyond COVID: The Environmental Challenge

If we look past the pandemic, climate change constitutes a major long-term concern for financial stabilityIf we look past the pandemic, climate change constitutes a major long-term concern for financial stability. . Climate events will unfortunately play a larger role in coming years, and their impact on economic cycles and financial losses needs to be taken into account. The earning prospects of entire sectors, such as oil and coal production, are likely to be affected, and lenders investing in them could face unpleasant reassessments of their portfolios. Failing to take into account environmental and climatic factors may well lead to a major crisis in the future.

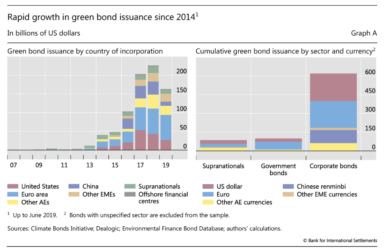

FIGURE 1 | RAPID GROWTH IN BOND ISSUANCE SINCE 2014. Taken from “BIS Quarterly Review”, September 2019, www.bis.org/publ/qtrpdf/r_qt1909.htm.

FIGURE 1 | RAPID GROWTH IN BOND ISSUANCE SINCE 2014. Taken from “BIS Quarterly Review”, September 2019, www.bis.org/publ/qtrpdf/r_qt1909.htm.The good news is that the financial sector and regulators have started recognising the issue, and are moving rapidly towards updating the models used to assess financial risk. A growing number of central banks have joined the Network for Greening the Financial System (NGFS), which is focused on handling the problem. Only time will tell whether this initiative will prove sufficient and timely enough to mitigate the impact of the coming climate events on the financial system.

Technological Disruption: Fintech and Cryptocurrencies

To add to injury, the financial sector is faced with a rapid technological change, driven primarily by non-bank actors. Advances in fintech are challenging the business of established financial firms, including banks, which ultimately will lead them to adapt to the benefit of the consumer. The emergence of cryptocurrencies similarly challenges the central role of official money as the main mean of payment. The well-known Libra project has been met with a strong reaction by central banks, and substantially evolved in response to the concerns voiced by policymakers.

Innovation usually provides the consumer with new products that existing entities would have been slow to adopt. Could it, however, make the financial system harder to monitor?Could the growing role of global technology companies in the provision of financial services overwhelm the ability of national regulators? Could the growing role of global technology companies in the provision of financial services overwhelm the ability of national regulators? This is a risk, and addressing this risk requires coordination among policymakers and joint efforts by central banks. Regulators and central banks have indeed become actively involved in shaping the evolution of the system, and updating the regulatory framework through the BIS Innovation Hub is a step in the right direction. Still, the risk of policymakers being “outgunned” by the new financial providers will have to be carefully monitored in the years ahead.

PODCAST | The Unlikely Hierarchy of Health Risk – Ryan Whitacre

Research Office, The Graduate Institute, Geneva.

PODCAST | La globalisation des diversités – Fabrizio Sabelli

Research Office, The Graduate Institute, Geneva.

PODCAST | AI, Big Data, and Big Risk? Michael Kende

Research Office, The Graduate Institute, Geneva.

PODCAST | The Fabrication of Terrorism Risk – Andrea Bianchi

Research Office, The Graduate Institute, Geneva.