Debt as a Political Weapon?

In July 2022, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), argued that a third external shock in the form of rising interest rates, after the pandemic and the war in Ukraine, would pose significant economic risks for developing countries and potentially usher in a debt crisis in emerging markets.

The debt crisis of the 1980s resulted in a “lost decade” for the countries concerned

This warning came almost exactly forty years after the beginning of the 1982 debt crisis in the developing world, triggered by a major shock in the oil markets following the 1970 Iranian Revolution, the so-called “Volcker shock” (when Paul Volcker, chairman of the Board of Governors of the Federal Reserve, decided to increase interest rates to fight inflation) and the ensuing US-led global recession in the early 1980s. The debt crisis that erupted in 1982 lasted for almost a decade, dubbed the “lost decade”, and was characterised by stagnating – if not declining – standards of living across several regions in the Global South.we might legitimately ask ourselves whether the poorer regions of the world are heading towards a new debt crisis, and how this debt might be instrumentalised by major powers The similarities with today’s woes (declining growth, rising inflation, geopolitical instability and an energy crisis) are uncanny, and we might legitimately ask ourselves whether the poorer regions of the world are heading towards a new debt crisis, and how this debt might be instrumentalised by major powers to further their geopolitical aims.

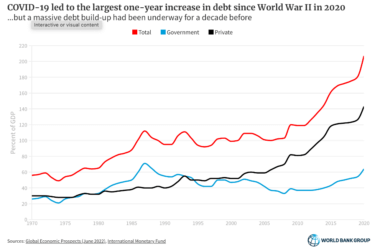

Many poorer countries had been accumulating debt for a decade before Covid-19

The still ongoing pandemic has exposed the brutal inequalities in the access to healthcare between the richer and the poorer countries. According to data from Johns Hopkins University, three Latin American countries (Peru, Chile and Brazil) have suffered some of the highest levels of Covid-related mortality. Dead bodies piled up in the streets of most cities in the Global South, and when vaccines were finally distributed, they were less effective than those deployed in richer countries.

As the pandemic ravaged the poorer regions of the world, Western countries pumped money into the economy to support businesses, consumers and, more generally, domestic economies, creating asset bubbles and, ultimately, fuelling a massive inflationary spiral.

Poorer countries had been piling up debt for almost a decade before the pandemic hit. According to the World Bank, between 2011 and 2019 the public debt in a sample of 65 developing countries increased by 18% of GDP on average. For certain regions the increase was much higher, such as Sub-Saharan Africa where debt increased by 27% on average. The pandemic itself fuelled the largest debt increase since World War II while the global United Nations Human Development Index has declined for two years in a row (2020 and 2021), with the greatest deteriorations in the Global South. According to the World Bank, 58% of the world’s poorest countries are today in debt distress or at high risk (compared to only 30% in 2015).

Foreign debt in the Global South today differs from the 1980s in several ways

If the similarities with the debt crisis that engulfed countries of the Global South in the 1980s are striking, so are the divergences.

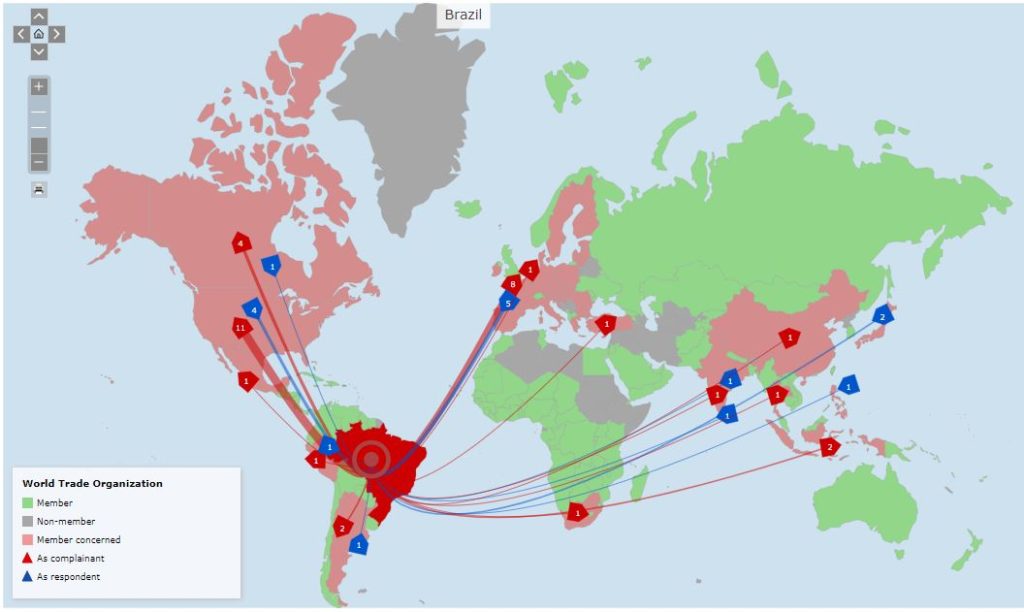

First, in the 1980s, the bulk of the developing world’s foreign debt was highly concentrated in a few countries, notably in Latin America (Mexico, Brazil and Argentina). Second, the debt mostly took on the form of commercial bank loans such as syndicated euro loans (US dollar loans issued by multiple commercial banks to limit risk). Third, the debt was renegotiated under the aegis of international financial institutions such as the International Monetary Fund. Fourth, Western countries (Europe, United States and Japan) still played a key role as providers of capital.

Today, the situation is markedly different: a wide range of countries across the Global South are in payment difficulties; loans are provided through a multiplicity of channels (e.g. commercial loans on international financial markets or bonds); and non-Western actors, notably China, now play a crucial role in developing regions. Accordingly, the poorest countries of the world today face novel and mostly unforeseeable challenges.

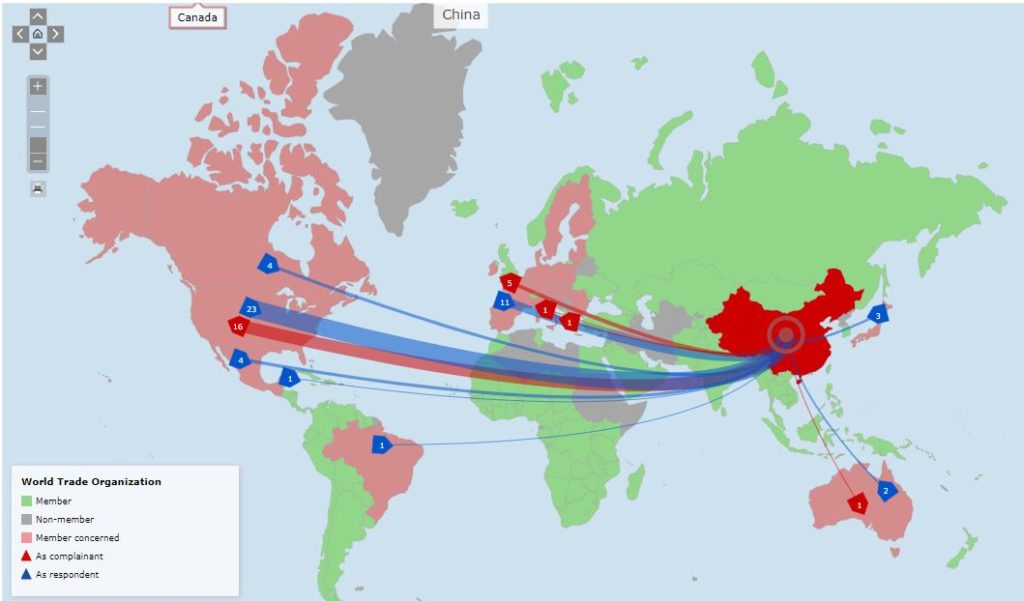

China accounts for an increasing share of foreign lending to developing countries

The role of China, in particular the possibility of China using debt as a political weapon or “trap”, deserves closer scrutiny. While China’s role in global trade has received extensive attention, its growing influence in international financial affairs has remained “more obscure” While China’s role in global trade has received extensive attention, its growing influence in international financial affairs has remained “more obscure” (Horn, Reinhart and Trebesch 2020). Available statistics (likely an underestimate) show that China’s lending to low- and middle-income countries grew from approximately USD 40 billion in 2010 to USD 170 billion in 2020 (Wang 2022).

In contrast to capital outflows from Europe or the United Sates, China’s overseas lending is dominated by government and various state-owned entities, often lending at market terms (as opposed to concessional terms).

The role and influence of China have become particularly visible in countries like Sri Lanka, in default since April 2022 for the first time in its history. The case of Sri Lanka’s Hambantota port is often cited as an example of “Chinese debt traps”, a term used by former US Vice President Mike Pence at the Hudson Institute in 2018. The construction of the port was financed by massive Chinese government investments, aggravating the country’s unsustainable levels of debt. In 2017, Sri Lanka granted state-owned China Merchants a controlling 70% stake in the port on a 99-year lease in return for further Chinese investment.The weaponisation of debt, however, is not a universally accepted narrative Sri Lanka is not the only example: the economic expansion of China in African countries like Djibouti, Angola, Zambia or Kenya is well documented, and Pakistan’s economic ties to China have also increased dramatically in the last decade (Kynge and others 2022). The weaponisation of debt, however, is not a universally accepted narrative and academics (for example, Brautigam and Rithmire 2021; Singh 2021) have argued against the “myth of debt-trap diplomacy”, asserting instead that ineffective domestic policies are to blame and that Chinese loans are not a major driver of debt distress.

The G20 has adopted two initiatives to address a potential debt crisis

Apart from China’s growing encroachment, developing countries – in the absence of a functioning debt-rescheduling framework – face high levels of uncertainty in case of debt distress. The G20 addressed this debt problem in 2020 with two initiatives for developing countries: first, the Debt Service Suspension Initiative (DSSI), which expired in December 2021, to tackle liquidity problems, and then the Common Framework for Debt Treatment beyond the DSSI (Common Framework) to address debt crises.

The G20 Common Framework, however, has proven only partially useful in supporting highly-indebted countries; by the end of 2021, only three – Chad, Ethiopia, and Zambia – had mobilised the instrument (Berensmann and others 2022). According to Kristalina Georgieva and Ceyla Pazarbasiogluis, the IMF’s Director of the Strategy, Policy and Review Department of the IMF, the framework has yet to deliver on its promise (Georgieva and Pazarbasioglu 2021). One reason for its current limitations is the non-participation of some bilateral and private creditors. Another is that potential applicants fear their access to commercial financing will be cut off if they apply. The glacial pace of restructuring is also a deterrent: countries want to avoid the economic uncertainty of protracted restructuring negotiations (Gill 2022).

In this uncertain and turbulent context involving the economic and political uses of debt, international aid is under threat from the war in Ukraine, as Western countries face increased defence, refugee, energy and shipping costs. It is still unclear whether the few cases of debt distress will result in a full-scale debt crisis in developing countries forty years after the 1982 crisis, or what role China’s “hidden debt” (debts that are not reported or under-reported on government balance sheets – see, for example, Malik and others 2021) might play in such scenario. In any event, the international financial community must rise to the challenge and understand that its collective response will likely mark the future of developing countries for years to come.

VIDEO: A critical analysis of the weaponisation of economics, by Beatrice Weder di Mauro

Research Office, Geneva Graduate Institute.

VIDEO: Why integrated trade networks matter, with Richard Baldwin

VOXeu and CEPR (Geneva Graduate Institute)

PODCAST: Are we moving towards a new economic cold war? with Cédric Dupont

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: Economic nationalism in the light of the long-term history of capitalism, with Gopalan Balachandran

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: Overview of the WTO challenges in 2022, with Manuel Miranda

Research Office, Geneva Graduate Institute, 2022. Globalchallenges.org

PODCAST: China and the changing global economic landscape, with Sung Min Rho

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: The Economic Weapon in Global Governance, with Nicholas Mulder

Geneva Graduate Institute

DEFINITIONS related to sanctions and economic warfare

Economic and financial sanctions are enforcement actions taken by a country or a group of countries against a targeted state, group, or individual that has been found in non-compliance with existing international law, treaty obligations and customary rules. They can take many forms, like restrictions on commercial or financial transactions, asset freezes, travel bans, or the withholding of economic and technical assistance. They pursue a variety of social, commercial and/or political objectives depending on the kind of violations committed by the target group or state. Usually, they are supposed to coerce targets of sanctions into compliant behaviour, but often, they serve to deter third countries from pursuing similar violations of international law commitments. As an enforcement action, sanctions are supposed to refer to a specific violation of existing law, rather than constitute a purely political measure.

An embargo is the partial or complete proscription of commerce with a particular country or a group of countries. It entails the ban of imports or exports of certain items, or whole sectors, or all products from or to a specified country. One of the most famous illustrations is the oil embargo imposed by the Organization of the Petroleum Exporting Countries (OPEC) in 1973 in retaliation to Western support for Israel during the Yom Kippur War. As a barrier to trade, an embargo should not be confused with a military blockade, although enforcement of the embargo could escalate into a military intervention. In contrast to sanctions, which are conceived as enforcement actions, an alliance of states can decide to erect an embargo based on political reasons, for instance, to help allies involved in a conflict by weakening the economy of inimical states.

Sanctions have been used to advance a range of foreign policy goals, including counterterrorism, counternarcotics, nonproliferation, democracy and human rights promotion, conflict resolution, and cybersecurity. Sanctions, while a form of intervention, are generally viewed as a lower-cost, lower-risk course of action between diplomacy and war. Still, the costs of sanctions are harder to measure, and human costs can be very high, especially when a whole economy is sanctioned, as in the case of “comprehensive sanctions” against Iraq in the 1990s, or when the whole financial system of a country is crippled, as in the case of “massified” targeted financial sanctions against Iran in the early 2010s.

As the UN’s principal crisis-management body, the Security Council (UNSC) may respond to global threats by imposing sanctions against states and nonstate groups who are found in non-compliance of international law. Sanctions resolutions must pass the fifteen-member council by a majority vote and without a veto from any of the five permanent members: the United States, China, France, Russia, and the United Kingdom. The most common types of UN sanctions, which are binding for all member states, are asset freezes, travel bans, and arms embargoes. UN sanctions regimes are typically managed by a special committee and a monitoring group. The global police agency INTERPOL assists some sanctions committees, but the UN has no independent means of enforcement and relies on member states, many of which have limited resources and little political incentive to prosecute noncompliance. Still, the private sector, and especially banking institutions, have come to integrate the names of front companies found in the reports of UN monitoring groups that document evasion practices of specific UNSC sanction regimes, which demonstrates the centrality attained by the UNSC in the management of sanctions. Prior to 1990, the UNSC had imposed sanctions against just two states: Southern Rhodesia (1966) and South Africa (1977), but there has been a long history of sanctions by the League of Nations, of which the UN is the successor organisation.

The European Union imposes sanctions, known more commonly in the 28-member bloc as “restrictive measures”, as part of its Common Foreign and Security Policy. Because the EU lacks a joint military force, many European leaders consider sanctions the bloc’s most powerful foreign policy tool, based on the experience attained during the early 2010s in the nuclear negotiation with Iran that lead to the signature of the JCPOA in 2015. Sanctions policies must receive unanimous consent from member states in the Council of the European Union, the body that represents EU leaders. Since its inception in 1992, the EU has levied sanctions more than 30 times (in addition to those mandated by the UN). Analysts say the “massified” targeted sanctions the EU bloc imposed on Iran in 2012 – which it lifted in 2015 as part of the Iran nuclear agreement (the Joint Comprehensive Plan of Action, JCPOA) – marked a turning point for the EU, which had previously sought to limit sanctions to specific individuals or companies.

The United States uses economic and financial sanctions more than any other country. Sanctions policy may originate in either the executive or legislative branch. Presidents typically launch the process by issuing an executive order (EO) that declares a national emergency in response to an “unusual and extraordinary” foreign threat, for example, “the proliferation of nuclear, biological, and chemical weapons” (EO 12938) or “the actions and policies of the Government of the Russian Federation with respect to Ukraine” (EO 13661). Many US sanctions regimes are administered by the Office of Foreign Assets Control (OFAC), located in the Department of the Treasury: OFAC is often considered an all-powerful organisation, as it is in charge of sanctions designations, sanctions exemptions and humanitarian licenses, and examination of delisting requests.

Economic nationalism is an ideology that advocates bolstering and protecting national economies in an effort to countenance or counteract the effects of trade liberalisation and globalisation. It aims to maximise national self-reliance by reverting to elements of protectionism and mercantilism. Economic nationalism privileges state control and interventionism over market mechanisms, profit maximisation and growth. It typically restricts flows of labour, capital, goods and services through protectionist measures such as tariffs, investment controls or export restrictions.

Reshoring is the opposite of offshoring. It refers to companies repatriating “back home” parts or all of their supply chains components, including back-office, manufacturing, or R&D processes. Nearshoring and friendshoring obey a logic similar to reshoring, but instead of production and manufacturing being repatriated back to the “home country”, they are relocated to neighbouring (nearshoring) or allied countries (friendshoring).

Research Office, Geneva Graduated Institute. Questions largely inspired by the Council on Foreign Relations, www.cfr.org.