The Politicisation of the Commodities Trade

The tendency towards the politicisation of economic relations is not new, but the Russian invasion of Ukraine marks a turning point. For the past half-century, the dominant narrative has been that closer economic interdependence would consolidate peace, and eventually also support democratisation and respect of human rights. Facts have validated this narrative until approximately the turn of the century, but in the last 20 years the trend has been moving in the opposite direction. Authoritarian regimes have only selectively adopted international norms, while testing the will of liberal democracies to defend their principles – in the belief that short-term economic interest and disunity would allow their infringement of norms to remain unpunished.

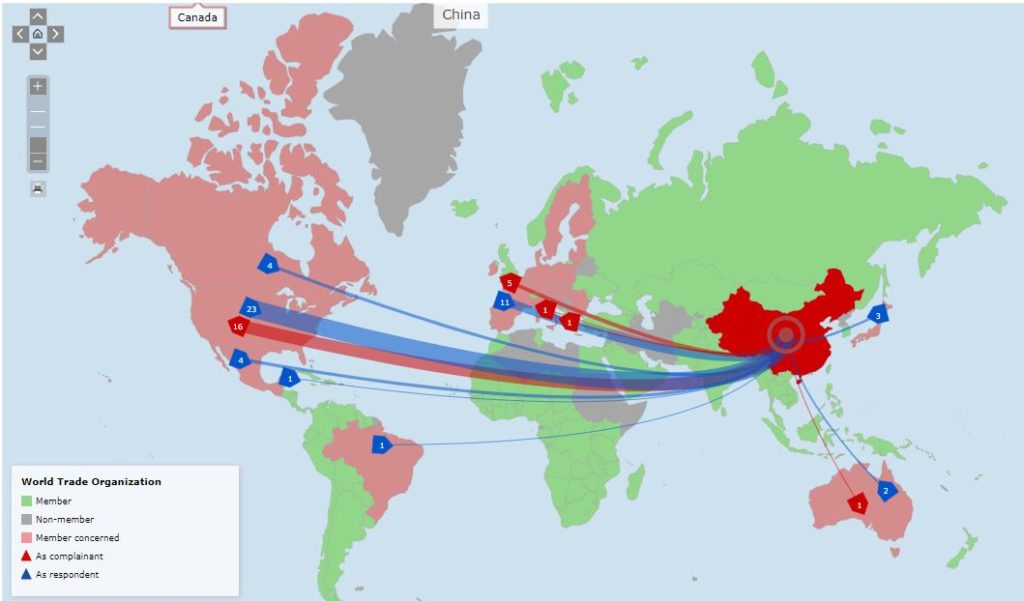

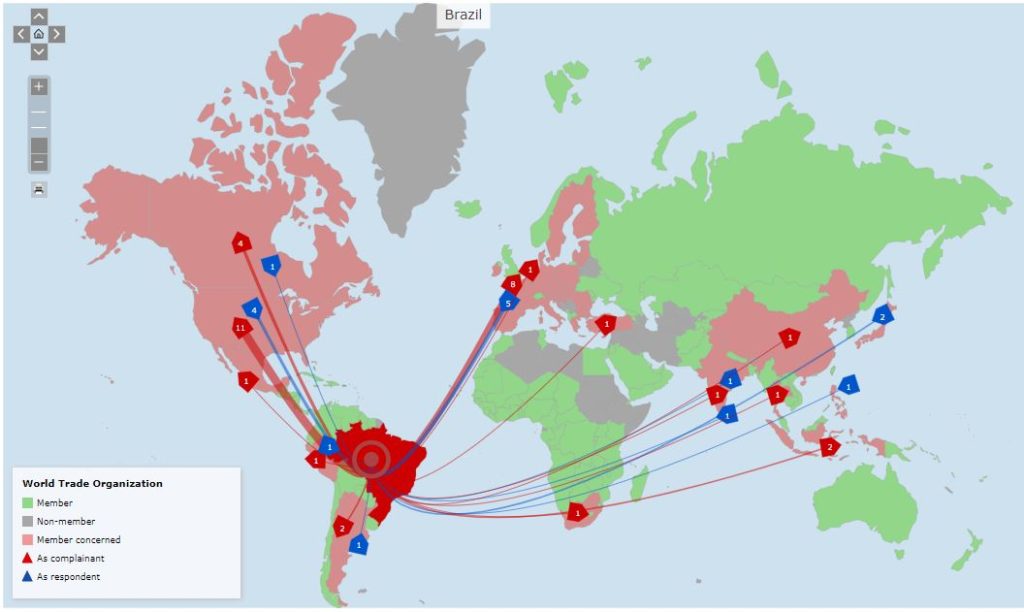

Pursuing economic interdependence with countries whose governments are cheating on the rules is not a wise strategy We now see that pursuing economic interdependence with countries whose governments are cheating on the rules is not a wise strategy. As many (most) commodity-exporting countries are ruled by authoritarian regimes, the politicisation of international trade inevitably impacts relations between industrial countries, which are primarily liberal democracies, on the one hand, and commodity exporters on the other. China occupies a special position, as a predominantly industrial country which, however, has come to dominate the production and refining of key metals, and is ruled by an increasingly authoritarian regime.

Commodities are often an essential source of income for authoritarian regimes

Two key considerations are weighting on the redefinition of trade patterns. The first is the extent to which exports of commodities generate a large producers’ rent that becomes an essential source of funding for authoritarian regimes. Importers underpin the generation of the rent, and cannot be indifferent to seeing funds used to pay for policies that run against their interests or values.

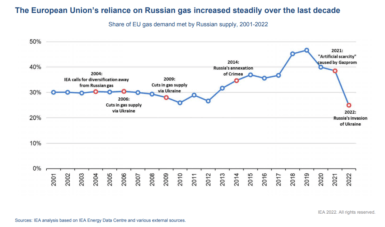

In this respect, commodities greatly differ from each other. Oil has historically generated vast rents, as the cost of production in some countries is just a tiny fraction of the price that the commodity commands on international markets. In normal times and until very recently, natural gas has been the poor relative to oil, as transportation costs are much higher, and the price obtainable for an equivalent energy content much lower. Nevertheless, the export of natural gas has been so important for certain countries that their fiscal capacity depends to a significant extent on the revenue generated. The Russian government’s revenue, in particular, has been highly dependent on taxation of exports of oil and, to a lesser extent, gas (roughly 50% of total revenue).

In contrast, coal and metals or agricultural products mostly generate much smaller rents. The margin of manoeuvre that they allow to governments of the countries producing them is limited – so that, while corruption, exploitation of workers (including children), and local violence or conflicts may be frequent, these countries rarely become a threat for their neighbours.

With commodities like natural gas, supply interruptions can have far-reaching effects

The second consideration is the extent to which potential supply interruptions may have a direct and widespread impact on the importing country’s economy and the well-being of its citizens. This depends, on the one hand, on the uses of the imported commodity, and, on the other hand, on the potential for accessing alternative sources. The latter in turn is a function of the diffusion of the commodity and of transport logistics.

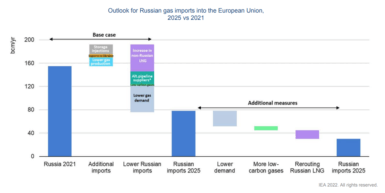

Alternative sources of natural gas are available, but limitations in transport infrastructure prevent a rapid reorientation of trade flows. The great difficulty that the European Union faces today with its dependence on Russian gas is that gas has an immediate impact on the well-being of millions of citizens that rely on it for heating and cooking, and cannot easily switch to an alternative in the short term. Gas is also essential to guarantee uninterrupted power generation in line with demand in most countries, and is a key raw material in many industries, including some, such as fertilisers, whose continuing activity is essential for entire sectors, e.g. agriculture. Alternative sources of natural gas are available, but limitations in transport infrastructure prevent a rapid reorientation of trade flows. This is not the case for oil, which is why reducing dependence on Russian oil is much easier than reducing dependence on Russian gas. Nevertheless, a protracted interruption of oil exports from a major producer can potentially inflict major damage on importing economies. (Note that Russian oil has not been completely shut off from European markets, and the reduction of exports to Europe has, for Russia, to some extent been compensated by higher exports to Asia.)

For other commodities, notably metals, the dependence is “strategic” in the sense that non-availability would cause the interruption of production in some industries, notably those related to the production of equipment for the electricity sector (cables, batteries, generators, motors, etc.). But the electricity sector does not consume metals and would be able to continue generating power with only limited problems. This means that the negative economic consequences of a disruption in access to metals would be significant and growing over time, but not immediately paralysing, in contrast to oil and gas. In this respect, dependence on imports of cereals and vegetable oils may be much more problematic – which is why many countries protect domestic food production against foreign competition, at least to some extent, for security reasons.

Cost is increasingly no longer the only concern for commodity importers

It is reasonable to expect that concern for security of supply will translate into voluntarist policies to reduce dependence on any one exporting country, and to favour trade with politically aligned or “acceptable” partners. This will likely mean moving away from a reliance on the lowest cost, most competitive suppliers, for the sake of diversification and security of supply. Trade will be politicised, if not weaponised in an aggressive sense; and we will rediscover political classifications like WOCA (World Outside Communist Areas), which were commonplace until some thirty years ago.

VIDEO: A critical analysis of the weaponisation of economics, by Beatrice Weder di Mauro

Research Office, Geneva Graduate Institute.

VIDEO: Why integrated trade networks matter, with Richard Baldwin

VOXeu and CEPR (Geneva Graduate Institute)

PODCAST: Are we moving towards a new economic cold war? with Cédric Dupont

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: Economic nationalism in the light of the long-term history of capitalism, with Gopalan Balachandran

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: Overview of the WTO challenges in 2022, with Manuel Miranda

Research Office, Geneva Graduate Institute, 2022. Globalchallenges.org

PODCAST: China and the changing global economic landscape, with Sung Min Rho

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: The Economic Weapon in Global Governance, with Nicholas Mulder

Geneva Graduate Institute

DEFINITIONS related to sanctions and economic warfare

Economic and financial sanctions are enforcement actions taken by a country or a group of countries against a targeted state, group, or individual that has been found in non-compliance with existing international law, treaty obligations and customary rules. They can take many forms, like restrictions on commercial or financial transactions, asset freezes, travel bans, or the withholding of economic and technical assistance. They pursue a variety of social, commercial and/or political objectives depending on the kind of violations committed by the target group or state. Usually, they are supposed to coerce targets of sanctions into compliant behaviour, but often, they serve to deter third countries from pursuing similar violations of international law commitments. As an enforcement action, sanctions are supposed to refer to a specific violation of existing law, rather than constitute a purely political measure.

An embargo is the partial or complete proscription of commerce with a particular country or a group of countries. It entails the ban of imports or exports of certain items, or whole sectors, or all products from or to a specified country. One of the most famous illustrations is the oil embargo imposed by the Organization of the Petroleum Exporting Countries (OPEC) in 1973 in retaliation to Western support for Israel during the Yom Kippur War. As a barrier to trade, an embargo should not be confused with a military blockade, although enforcement of the embargo could escalate into a military intervention. In contrast to sanctions, which are conceived as enforcement actions, an alliance of states can decide to erect an embargo based on political reasons, for instance, to help allies involved in a conflict by weakening the economy of inimical states.

Sanctions have been used to advance a range of foreign policy goals, including counterterrorism, counternarcotics, nonproliferation, democracy and human rights promotion, conflict resolution, and cybersecurity. Sanctions, while a form of intervention, are generally viewed as a lower-cost, lower-risk course of action between diplomacy and war. Still, the costs of sanctions are harder to measure, and human costs can be very high, especially when a whole economy is sanctioned, as in the case of “comprehensive sanctions” against Iraq in the 1990s, or when the whole financial system of a country is crippled, as in the case of “massified” targeted financial sanctions against Iran in the early 2010s.

As the UN’s principal crisis-management body, the Security Council (UNSC) may respond to global threats by imposing sanctions against states and nonstate groups who are found in non-compliance of international law. Sanctions resolutions must pass the fifteen-member council by a majority vote and without a veto from any of the five permanent members: the United States, China, France, Russia, and the United Kingdom. The most common types of UN sanctions, which are binding for all member states, are asset freezes, travel bans, and arms embargoes. UN sanctions regimes are typically managed by a special committee and a monitoring group. The global police agency INTERPOL assists some sanctions committees, but the UN has no independent means of enforcement and relies on member states, many of which have limited resources and little political incentive to prosecute noncompliance. Still, the private sector, and especially banking institutions, have come to integrate the names of front companies found in the reports of UN monitoring groups that document evasion practices of specific UNSC sanction regimes, which demonstrates the centrality attained by the UNSC in the management of sanctions. Prior to 1990, the UNSC had imposed sanctions against just two states: Southern Rhodesia (1966) and South Africa (1977), but there has been a long history of sanctions by the League of Nations, of which the UN is the successor organisation.

The European Union imposes sanctions, known more commonly in the 28-member bloc as “restrictive measures”, as part of its Common Foreign and Security Policy. Because the EU lacks a joint military force, many European leaders consider sanctions the bloc’s most powerful foreign policy tool, based on the experience attained during the early 2010s in the nuclear negotiation with Iran that lead to the signature of the JCPOA in 2015. Sanctions policies must receive unanimous consent from member states in the Council of the European Union, the body that represents EU leaders. Since its inception in 1992, the EU has levied sanctions more than 30 times (in addition to those mandated by the UN). Analysts say the “massified” targeted sanctions the EU bloc imposed on Iran in 2012 – which it lifted in 2015 as part of the Iran nuclear agreement (the Joint Comprehensive Plan of Action, JCPOA) – marked a turning point for the EU, which had previously sought to limit sanctions to specific individuals or companies.

The United States uses economic and financial sanctions more than any other country. Sanctions policy may originate in either the executive or legislative branch. Presidents typically launch the process by issuing an executive order (EO) that declares a national emergency in response to an “unusual and extraordinary” foreign threat, for example, “the proliferation of nuclear, biological, and chemical weapons” (EO 12938) or “the actions and policies of the Government of the Russian Federation with respect to Ukraine” (EO 13661). Many US sanctions regimes are administered by the Office of Foreign Assets Control (OFAC), located in the Department of the Treasury: OFAC is often considered an all-powerful organisation, as it is in charge of sanctions designations, sanctions exemptions and humanitarian licenses, and examination of delisting requests.

Economic nationalism is an ideology that advocates bolstering and protecting national economies in an effort to countenance or counteract the effects of trade liberalisation and globalisation. It aims to maximise national self-reliance by reverting to elements of protectionism and mercantilism. Economic nationalism privileges state control and interventionism over market mechanisms, profit maximisation and growth. It typically restricts flows of labour, capital, goods and services through protectionist measures such as tariffs, investment controls or export restrictions.

Reshoring is the opposite of offshoring. It refers to companies repatriating “back home” parts or all of their supply chains components, including back-office, manufacturing, or R&D processes. Nearshoring and friendshoring obey a logic similar to reshoring, but instead of production and manufacturing being repatriated back to the “home country”, they are relocated to neighbouring (nearshoring) or allied countries (friendshoring).

Research Office, Geneva Graduated Institute. Questions largely inspired by the Council on Foreign Relations, www.cfr.org.